Decarbonizing transport is a major challenge for reducing emissions that contribute to climate change. The transportation sector is responsible for about one-quarter of all energy-related CO2 emissions worldwide, with light-duty cars and trucks accounting for around half of the transport energy use and emissions. Electric-drive vehicles (EDVs) and hydrogen fuel cell vehicles (FCVs) powered by low-carbon sources have the potential to reduce carbon emissions. However, these vehicles only comprise about 0.3% of the global private vehicle fleet. Governments and automakers across the world have set ambitious sales targets for EDVs in order to increase their share of the fleet and their impact on petroleum use and emissions. However, to become commercially viable, consumers must be willing to choose these vehicles over their petroleum-powered counterparts.

In order to develop strategies to encourage consumers to purchase these vehicles and to predict their impacts, a better understanding of the factors that affect purchase decisions is crucial. Financial considerations, such as purchase price, fuel costs, and maintenance costs, will be important factors in purchase decisions. However, non-monetary factors, such as anxiety over limited driving range, limited refueling availability, limited variety in model choice, and overall risk associated with new technologies, will likely play an important role in consumer decisions as well. Studies have also shown that financial and non-financial preferences are markedly heterogeneous for consumers in various geographies and cultures.

Energy-economy models are useful for integrated energy-climate policy analysis because they have broad energy and emissions coverage and capture many of the complex inter-relationships between different sectors of the energy system over time and space. However, many of these models have no way to capture the heterogeneous nature of consumer decisions, do not consider non-monetary costs to consumers, and, despite being global models, do not differentiate how vehicle choice factors vary over different regions and cultures.

Researchers from six European countries and the United States have conducted a study aimed at projecting the effects of both financial (carbon pricing) and non-financial factors in aiding the global transition from conventional petroleum-powered light-duty vehicles towards low-carbon alternative fuel vehicles. Unlike other studies, this study combines six global energy models along with a consumer choice model that allows researchers to evaluate heterogeneous, non-financial factors in consumer vehicle choices.

Modeling Global Climate Policy and Non-monetary Costs

This study uses six global energy-economy models developed by research institutions from across Europe:

- GEM-E3T – A recursive-dynamic, general equilibrium model developed by the Institute of Communication and Computer Systems - National Technical University of Athens (ICCS/NTUA) in Greece

- IMACLIM-R – A multi-sector multi-region dynamic recursive growth model developed by Centre International de Recherche sur l’Environnement et le Développement (CIRED) in France

- IMAGE – A recursive-dynamic, partial equilibrium model developed by the PBL Netherlands Environmental Assessment Agency

- MESSAGE-Transport – An inter-temporal optimization, general-equilibrium model developed by the International Institute for Applied Systems Analysis (IIASA) in Austria

- TIAM-UCL – An inter-temporal optimization, partial-equilibrium model developed by the University College London (UCL) Energy Institute in the United Kingdom

- WITCH – An inter-temporal optimization, general equilibrium model developed by the Eni Enrico Foundation in Italy

These models were selected because they represent state-of-the-art scenario development tools that are widely used to evaluate the costs, potentials, and consequences of different energy, climate, and human development futures over the medium to long term. They also have different structures and solution algorithms, spanning a range from least-cost optimization to computable general equilibrium models and from game-theoretic to recursive-dynamic simulation models. Furthermore, each uses a "whole-system" framework in the sense that all sectors of the world's economy are captured and all countries/regions of the world are represented.

While these models have been regularly used to inform energy-climate policy over the past two to three decades, nearly all of the studies in recent years have focused on the dynamics of the long-term energy system transition from the lens of technology and policies. The specifics of human behavior have largely been ignored. Therefore, the task of including heterogeneous behavioral features in the models of this study has necessitated the transfer of insights, data, and reduced-form relationships from a more detailed transport sector model. The Market Acceptance of Advanced Automotive Technologies (MA3T) model, developed by Oak Ridge National Laboratory (ORNL), is a multinomial logit vehicle choice model that estimates consumer choice probabilities for a variety of vehicle types. While MA3T was originally developed with empirical data specific to the United States light-duty vehicle market, the (dis)utility costs generated by the model can be extended to other countries and regions by applying simple regional multipliers.

For the study, the MA3T model was used to represent five non-financial vehicle purchase factors:

- Range anxiety (limited vehicle driving range)

- Refuelling station availability (for non-electric vehicles)

- Risk premium (attitude toward new technologies)

- Model variety/availability (diversity of vehicles offered for sale)

- Electric vehicle charger installation (home/work/public)

Consumers' preferences for these non-financial attributes were monetized, drawing on the empirical data and relationships embedded within the MA3T model.

Global climate policy was modeled using economy-wide carbon pricing varying from US$0 to US$100 per ton of CO2 (tCO2). Carbon pricing is a charge paid for carbon emissions, and it is the principal lever used for promoting energy efficiency and low-carbon energy in analysis models. Carbon pricing of US$100 would amount to about US$1.10/gallon or about US$500 per year for the average U.S. driver operating a new conventional gasoline vehicle in real-world conditions.

There are a number of issues with using international carbon pricing as the sole instrument for incentivizing change, especially in the transport sector. Therefore, two scenarios representing consumer attitudes toward non-financial attributes were also modeled: (1) an "AFV Push" scenario, which models a major shift in people's views regarding non-financial attributes of AFVs, and (2) a "No AFV Action" scenario in which consumers' current views persist across all non-financial attributes. The various combinations of consumer scenarios and carbon pricing levels used in the study are provided in the table below.

The methodology and results of this study are described in more detail in Interaction of Consumer Preferences and Climate Change Policies in the Global Transition to Low-Carbon Vehicles.

| Climate policy (economy-wide carbon pricing) | ||||

|---|---|---|---|---|

| Transport strategies and policies influencing consumer preferences | AFV Push (+ US$0/tCO2) |

AFV Push (+ US$30/tCO2) |

AFV Push (+ US$50/tCO2) |

AFV Push (+ US$100/tCO2) |

| No AFV Action (+ 0 US$/tCO2) |

No AFV Action (+ 30 US$/tCO2) |

No AFV Action (+ 50 US$/tCO2) |

No AFV Action (+ 100 US$/tCO2) |

|

Results

Vehicle Travel

The study results suggest that a mixture of strong transportation strategies and policies can steer the market share of AFVs, particularly those powered by electricity and hydrogen, toward substantially higher levels. As shown in Figure 1, by 2050, electric-drive vehicles are projected to account for 15% to 34% of global light-duty vehicle travel, about 24% on average, under the AFV Push scenario. Furthermore, carbon pricing alone is not sufficient to drive the transition to EDVs, at least when considering prices of US$100/tCO2. As shown in Figure 1, EDVs account for no more than 3% of light-duty vehicle travel under the No AFV Action scenario.

Global Stock of AFVs

Five of the six models in the study were used to project the global stock of plug-in hybrids, battery electric vehicles, and fuel cell vehicles for 2030 and 2050—the IMAGE model tracks passenger-kilometers rather than vehicle stocks. Assuming a carbon pricing rate of US$100/tCO2 beginning after 2020, the projected global stock of these vehicles for the AFV Push scenario is much higher than the stock predicted for the No AFV Action scenario (Figure 2). The AFV stock for the AFV Push scenario ranged from 281.8 million to 644.8 million across models, with an average of 478 million. The projected AFV stock under the No AFV Action scenario ranged from 0 to 56.9 million, with an average of 26.7 million.

Models differed on the projected mix of plug-in hybrids and battery electric vehicles. None of the models projected a significant number of fuel cell vehicles by 2050.

CO2 Emissions Reduction

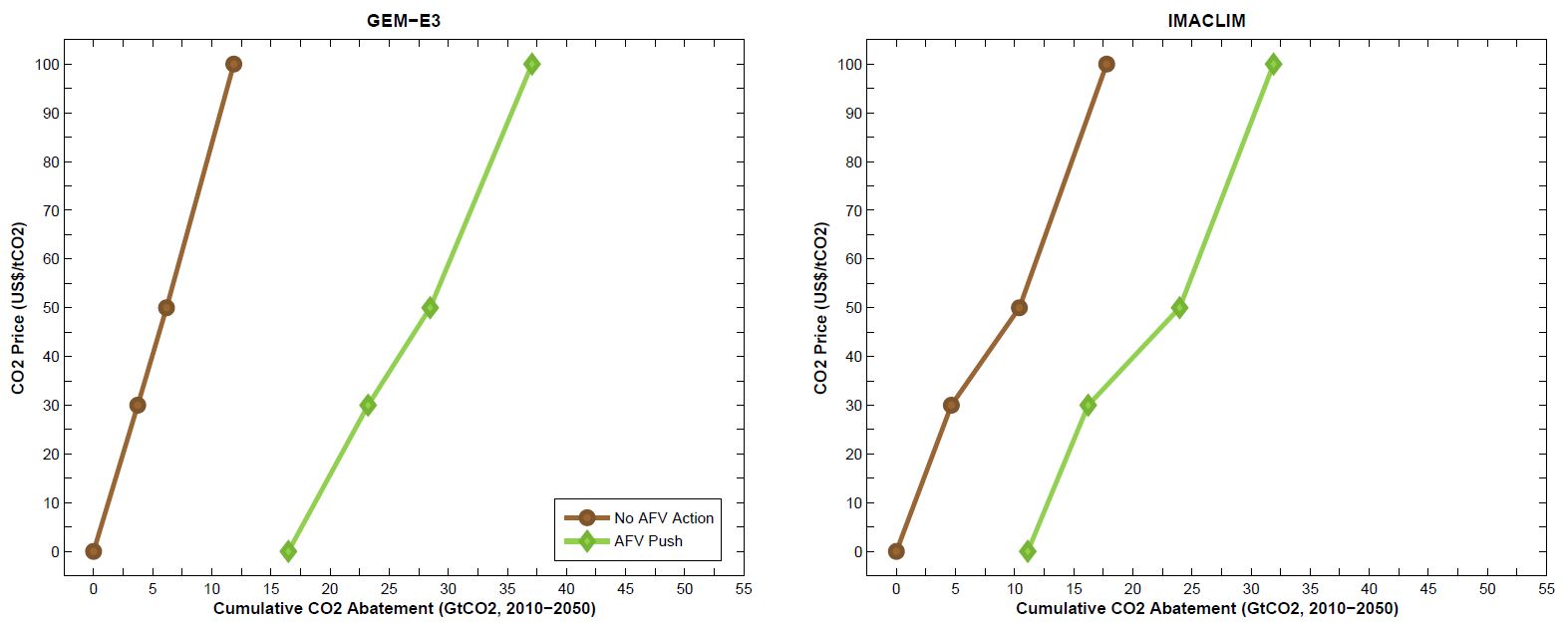

From 2010 to 2050, global cumulative CO2 emissions reductions (well-to-wheel) under the AFV Push scenario are projected to be 33 GtCO2 on average across models–almost double the 17 GtCO2 projected under the No AFV Action scenario—when both are coupled with the strongest carbon pricing rates modeled.

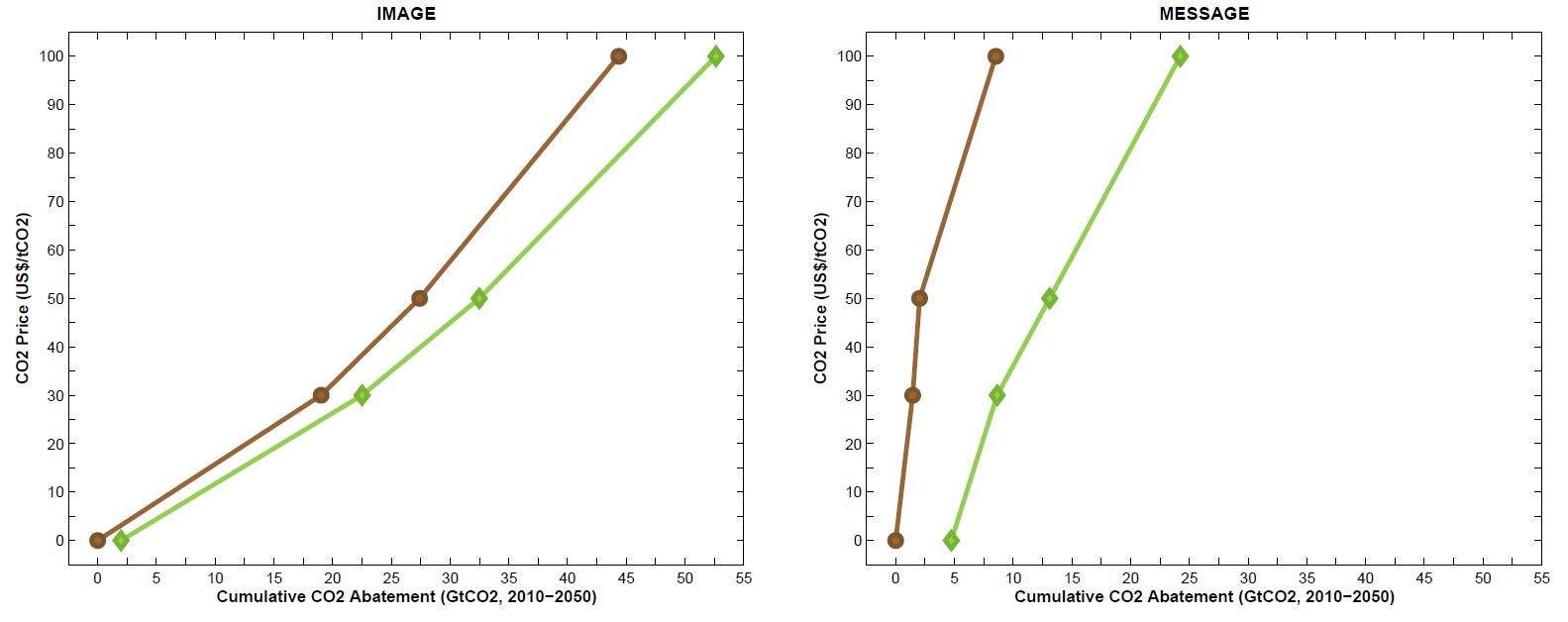

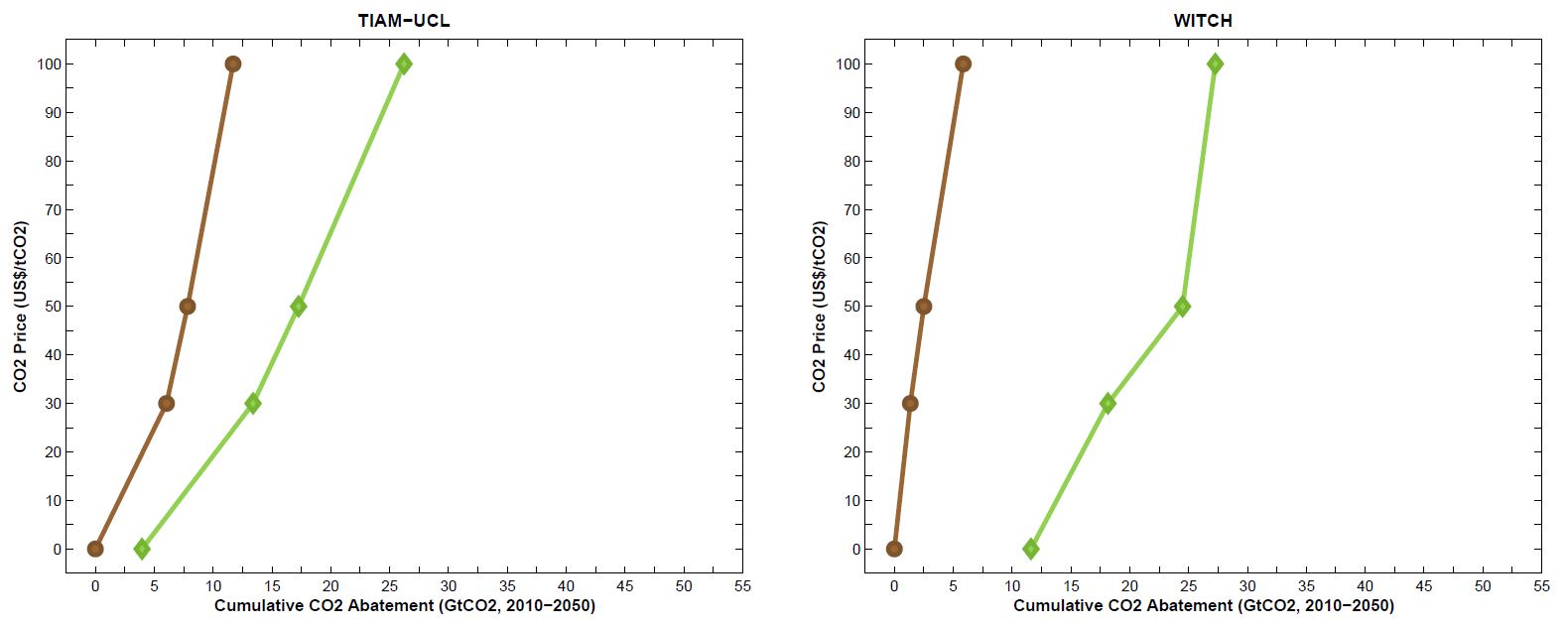

Figure 3 shows these emissions reductions in the form of marginal abatement cost (MAC) curves for the suite of carbon pricing schedules under both scenarios. (Note that costs and reductions are calculated relative to the No AFV Action scenario coupled with zero carbon pricing.) The steep MAC curves for the No AFV Action scenario suggest that emissions are somewhat inelastic to increasing carbon pricing under this scenario, with the emissions under the AFV Push scenario being only slightly more elastic. Moreover, the gap between the two curves generally increases along with increases in carbon pricing. This suggests that while carbon pricing may not be sufficient on its own for driving the transition to AFVs, it can still serve as a helpful complement to targeted sectoral actions if the ultimate goal is to ensure that the electricity and hydrogen used to power vehicles is derived from low-carbon sources.

The pronounced rightward shift of the AFV Push scenario curves indicate that that the strategies and policies envisioned in that scenario can increase the mitigation potential significantly, as much as double or triple in most cases.

Conclusions

Concerted near-to-long-term actions to address non-financial aspects of consumer preferences are critical to the ultimate success of alternative fuel vehicles. Actions targeting consumer preferences toward AFVs can provide a major boost to transport sector de-carbonization efforts. While financial incentives influencing fuel prices can play a supporting role, they do not appear to be sufficient for driving the AFV transition on their own.

Behavior-influencing measures could have a considerably larger transport CO2 emissions reduction impact in the OECD than in DevAsia. Over the next few decades to 2050, strategies and policies influencing consumer preferences in the realm of private vehicle choice can have a greater overall emissions benefit in OECD countries than elsewhere.

Looking toward the feasibility of achieving international targets such as those put forward in the "Paris Declaration on Electro-Mobility and Climate Change and Call to Action" or the "EV30@30" campaign, the model results suggest that these targets may prove challenging to achieve, when considering the diverse needs, considerations, and preferences of consumers.

Finally, from a modelling point of view, the analysis suggests that an enhanced treatment of heterogeneous, non-financial behavioral features in global energy-economy models lends them greater explanatory power than when such features are not treated explicitly or are mostly ignored.